Global Online Payment Fraud May Surpass $362 Billion, Driven by eCommerce Boom in Emerging Markets: Juniper Research.

Global Online Payment Fraud May Surpass $362 Billion, Driven by eCommerce Boom in Emerging Markets: Juniper Research.

Juniper Research, a renowned global leader in digital market intelligence and forecasting, has released a new study predicting a worrying trend. The research suggests that eCommerce merchants worldwide are set to lose over $362 billion to online payment fraud over the next five years, with $91 billion anticipated to be lost in 2028 alone. What is the primary driver of this alarming surge? A marked increase in eCommerce transactions within emerging markets.

With the Internet becoming increasingly accessible worldwide, many developing economies are witnessing a significant uptick in online commerce. While this development heralds enormous potential for economic growth, it also exposes businesses to heightened risk. As they navigate this burgeoning digital marketplace, merchants face new and sophisticated threats, including the escalated use of AI in fraudulent attacks.

Online payment fraud involves unauthorized or deceitful transactions conducted online and is executed via various fraudulent techniques. These include but aren’t limited to, phishing, account takeover, and even identity theft. Juniper’s report, titled Online Payment Fraud: Market Forecasts, Emerging Threats & Segment Analysis 2023-2028, provides an in-depth exploration of these issues. A free sample of this report can be downloaded here.

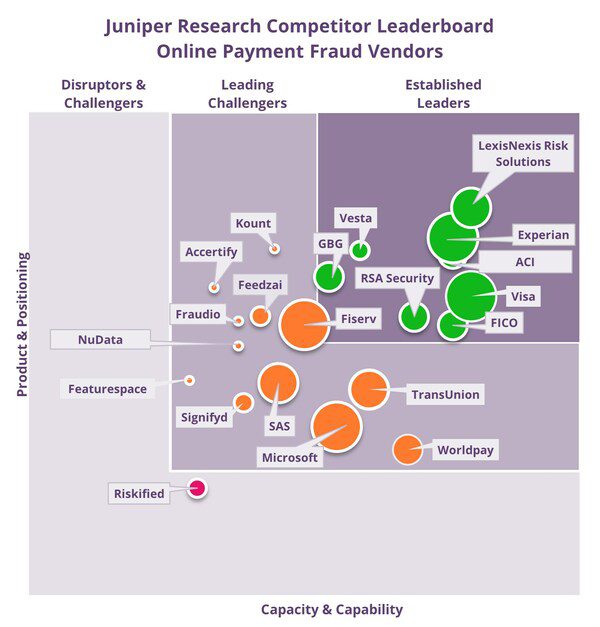

In a related development, Juniper Research also unveiled its Competitor Leaderboard for 2023, ranking the top 21 vendors in fraud detection and prevention. The study considered several critical factors, including the size of the customer base, the comprehensiveness of their solutions, and their future business prospects.

According to the Leaderboard, the top 5 vendors for 2023 are:

- LexisNexis Risk Solutions

- Experian

- ACI Worldwide

- Visa

- FICO

These companies were praised for their comprehensive anti-fraud orchestration capabilities and their full use of AI in analysing trends in fraudster behaviour. To stay ahead in this rapidly evolving space, vendors must leverage the data collected throughout the eCommerce process to refine their fraud detection and prevention solutions, primarily through training and developing advanced AI models.

The report’s author, Cara Malone, stressed the importance of vendors educating their clients on data sharing. She noted, “Fraud detection and prevention providers must emphasize the significance of data sharing to their clients. This approach is particularly critical in the context of AI, which relies on diverse data to detect fraud patterns. It’s particularly beneficial in an environment where fraudsters typically attack at scale rather than target a specific customer.”

As the digital landscape evolves, so does the risk of online payment fraud. eCommerce businesses, particularly those in emerging markets, must be vigilant and proactive in safeguarding their operations against these rapidly advancing threats. Undeniably, a greater risk of fraud comes with more excellent connectivity. As such, investing in advanced fraud detection and prevention systems cannot be overstated.

The Juniper Research report offers invaluable insights into this alarming issue and should be considered required reading for any merchant operating in the digital sphere. You can view the research here.

Written by: Jill Walsh